capital gains tax rate australia

In order to calculate how much capital gains. Your expenses are 70000.

Capital Gain Definition Types Corporate Tax Rates Example

For residential property from 6 April 2016 onwards the rate of capital gains tax is 18 to the extent that the beneficiarys taxable income is less than the income tax basic rate band and.

. Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the. The amounts that are subject to tax vary but the resulting capital gain is included with your income and taxed at whatever marginal rate you. Less any capital losses.

The top tax rate on ordinary income is 465 percent this makes the top capital gains tax rate 2325 percent. Use the calculator or steps to work out your CGT including your capital proceeds. One of the most obvious things you can do is hold the asset for a minimum of 12 months to access the 50 general discount.

The corporate tax rate in Australia is 30 percent above the OECD average 236 percent. 2021 capital gains tax calculator. Less any discount you are entitled to on your gains.

Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the. Corporations are limited in their ability to write off investments. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Check if you are eligible for the 50 CGT discount as a foreign resident. Sourced from the Australian Tax Office.

Sharesights award-winning investment portfolio tracker includes a powerful Australian capital gains tax report that functions as a CGT calculator determining capital gains made on sold. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations. CGT discount for foreign residents.

A third of gains on assets in superannuation funds is also excluded from income. The CGT applied only to assets acquired on or. How to calculate your crypto Capital Gains value.

2022 capital gains tax rates. As a result his tax payable would be 29467 37c for each 1 over 120000. The capital gain is taxed in the year the asset is sold.

Your total capital gains. Capital Gains tax in Australia is not a separate tax. Capital gains are taxed at the same rate as taxable income ie.

As a foreign resident find out which of your assets are. If you earn 40000 325 tax bracket per. You sell the rental property for 600000.

Use the cost thresholds to check if your capital improvements are subject to CGT. In Australia although it is referred to as Capital Gains Tax there is no separate tax and any gains you make will be assessable income subject to Income Tax. You pay tax on your net capital gains.

How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. Hold the asset for a minimum of 12 months. There is a capital gains tax CGT discount of.

It forms part of the. The Capital Gains Tax CGT regime was introduced in Australia with effect from 20 September 1985. If you own the asset for longer than 12 months you will pay 50 of the capital gain.

Your income is 75000 and your annual tax rate is 325. A capital gains tax CGT was introduced in Australia on 20 September 1985 one of a number of tax reforms by the Hawke Keating government. Capital Gains Tax Calculator Values.

You purchased your rental property for 350000. Check if your assets are subject to CGT exempt or pre-date CGT. Check if your assets are subject to CGT exempt or pre-date CGT.

How To Minimise Capital Gains Tax Cgt

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

2019 Year End Tax Planning Guide Mazars Australia

6 Resident Versus Non Resident Tax Status

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Biden To Propose Almost Doubling Capital Gains Tax Rate For Wealthy Individuals Bloomberg 1450 Am 99 7 Fm Whtc Holland

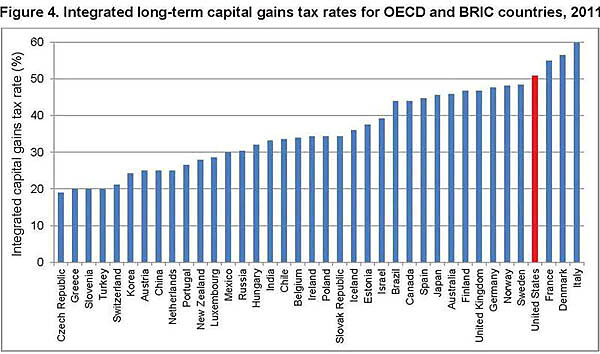

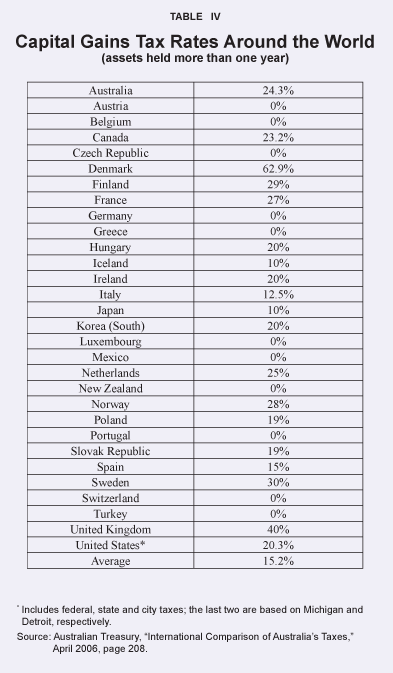

How Can Obama Look At These Two Charts And Conclude That America Should Have Higher Double Taxation Of Dividends And Capital Gains Cato At Liberty Blog

Australia Tax Income Taxes In Australia Tax Foundation

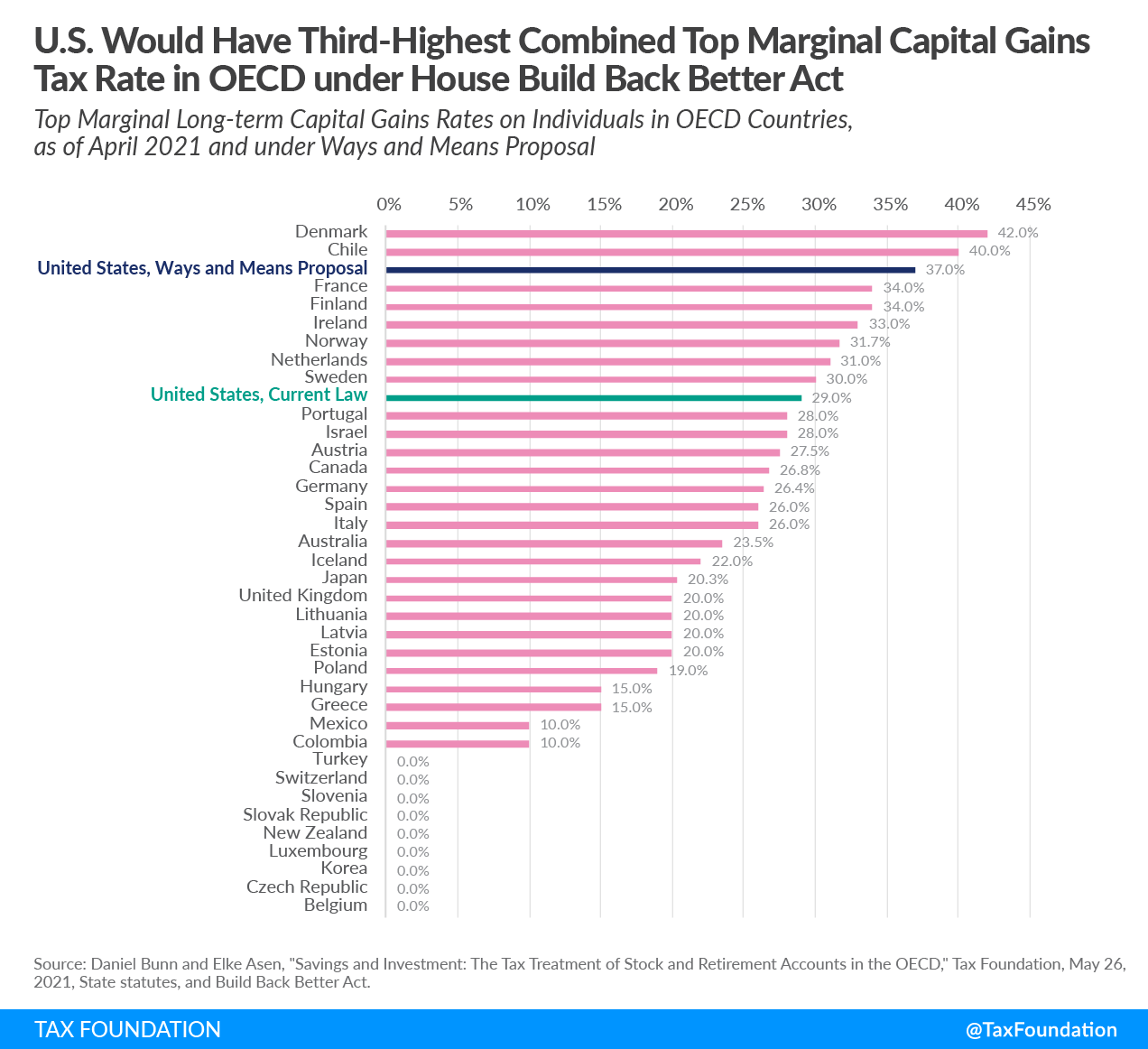

The Us Would Have The Third Highest Combined Top Marginal Capital Gains Tax Rate Among Oced Countries Topforeignstocks Com

تويتر Liberal Party على تويتر Labor S 50 Capital Gains Tax Increase Would Give Australia One Of The Highest Rates In The World Hurting Around 900 000 Everyday Australian Investors And Our Economy

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

What Is Capital Gains Tax And When Might I Pay It Amp

Calculating And Paying Capital Gains Tax Nab

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Why Capital Gains Tax Rates Should Be Lower Than Those On Labor Income American Enterprise Institute Aei